TrakInvest - World's first virtual social trading platform for equities and cryptocurrencies powered by proprietary AI engine

website : https://trakinvest.ai/

TrakInvest is the world’s first virtual social investment platform for equities. The platform combines social media and compensation-incentive based investing into a simple user interface, providing its user base a simple and unique tool to communicate and share trading activity on a real time basis.

The incentive to provide investment education, tools and financial benefits to people without ready access to capital has been absent for some time. Trakinvest platform seeks to empower millennials by (I) providing AI tools to make better informed investment decisions and (ii) creating a reward based economy to incentivize people for their data and insights, regardless of income, or location. TrakInvest utilizes the concepts of Social Trading, Robo-Advisory and Artificial Intelligence (AI) to deliver this value proposition to it’s growing community of 100,000+ users.

TrakInvest revolutionizes the traditional investment format by allowing users, regardless of their experience, exposure or ability to participate by providing them with transparency and “TRAKing” features such as “Copy Trade” to maximize their return potential.

TrakInvest provides white-labelled solutions for access to its key features for marketing and new customer acquisition to companies in the Financial Services Sector. Companies train new users or engage existing users to invest in stock markets. With a simulated environment across 10 international stock exchanges and over 18,000 stocks, customers practice stock investing without losing real money and once confident can invest with real money leading to brokerage revenue for our Corporate partners. We provide “whitelabelled” solutions to our Corporate customers that includes our various components and tools offered on our web, mobile and messenger applications. TrakInvest’s approach to innovation revolves around a learn-share-earn core. The portal is designed to incentivise new users and seasoned investors alike through meaningful financial incentives, insights and career opportunities. The idea ultimately, is to be the bridge between those with alpha generating ability and talent, but limited to no capital, and those with capital but not necessarily the time, alpha generation ability or inclination.

The portal allows users to create groups to share information and insight on equities and sectors. It allows users to showcase their level of knowledge on specific sectors and stocks, and to learn from others on sectors they want to get better at. The actual trading happens in real time during market hours in the markets covered including Singapore, Hong Kong, and China, India, Australia, and the US, and that forms the basis of their investment track record. In Q1 2018 TrakInvest will be introducing a similar product to also trade crypto-currencies.

Growing Community

TrakInvest is best set up to implement this project as, TrakInvest Pte. Ltd., already has a strong three-year track record and has built up a community of 100,000 in Asia comprised of millennials with strong existing partnerships with corporates, universities, and governments in Asia..

Reward Economy

The community continues to provide invaluable trading data, insights, and sentiments through the platform by maintaining a virtual trading portfolio on the current platform. At the application level, the token utilities will include: (i) Tokenized data ownership, (ii) Tokenized reputation system, and (iii) Tokenized certifications.

The community continues to provide invaluable trading data, insights, and sentiments through the platform by maintaining a virtual trading portfolio on the current platform. At the application level, the token utilities will include: (i) Tokenized data ownership, (ii) Tokenized reputation system, and (iii) Tokenized certifications.

TrakInvest AI

TrakInvest will also be introducing our “crowdsourced” sentiments tools and models in 2018 that have been developed using our TrakInvest user’s proprietary trading data and behavior collected over the past three years.

TrakInvest will also be introducing our “crowdsourced” sentiments tools and models in 2018 that have been developed using our TrakInvest user’s proprietary trading data and behavior collected over the past three years.

The world’s first virtual social trading platform on blockchainwith successful operations across Asia for past 3 years.

Trakinvest, a virtual social trading platform, currently offers users the ability to share their investment expertise with other members of the network for a fee, provides “crowdsourced” sentiment, forecasting and prediction tools using innovations in smart contracts, machine learning, NLP and artificial intelligence, and digital certification programs in online trading.

In 2018, TrakInvest will introduce second-generation “crowdsourced” sentiment tools and sentiment models that use trade and behavior data collected over the past 3 years.

TrakInvest is making plans increase the scalability of the current platform by balancing the blockchain technology while the security and transparency levels is being enhanced. It is backed by a powerful strong tech stack and in which the ecosystem has a strong technical foot holding based on the strength of the Ethereum’s Open Community network. It is also backed by a highly-experienced management team and an advisory board. The global advisory board is mainly comprised of individuals and existing investors with strong global experience and exposure in technology, media, telecommunications, financial services and cryptocurrencies.

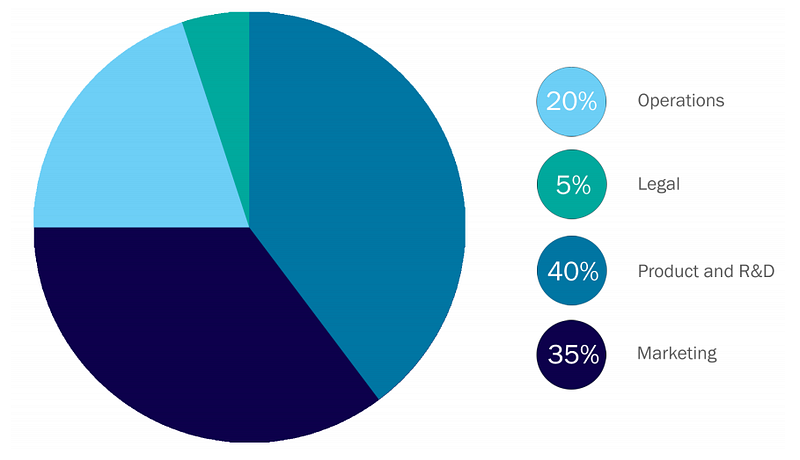

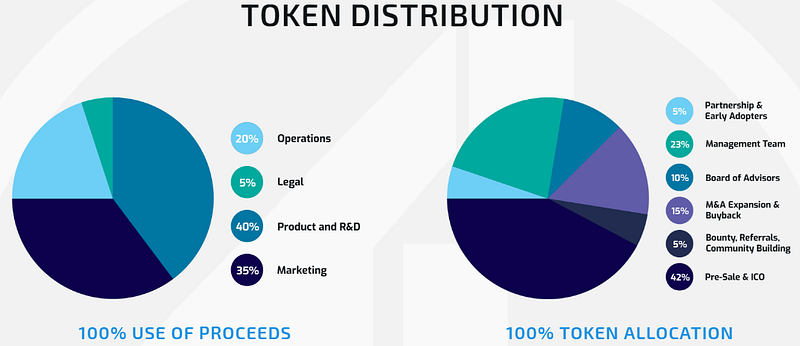

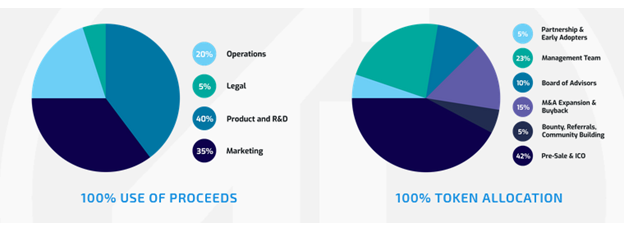

Use of Proceeds

TrakInvest ICO is looking to distribute 66 million TRAK tokens denominated in ETH. The proceeds from the ICO will be utilised for product extension and geographical expansion.

About ICO And Token

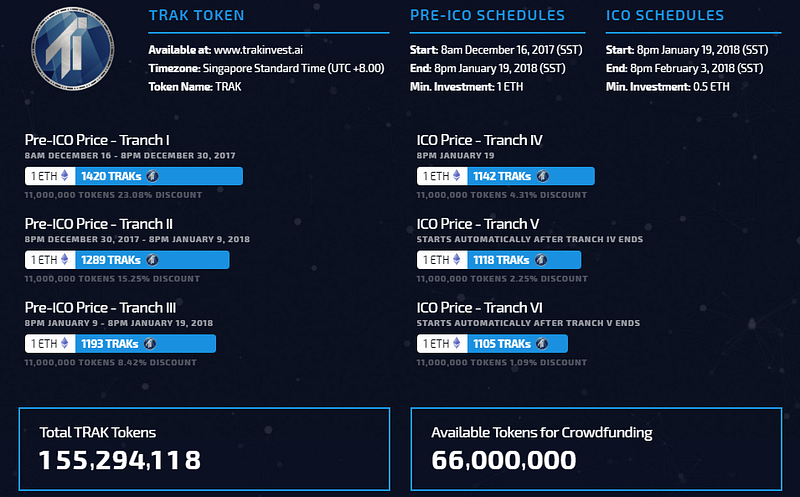

Token Name : TRAK

Website : www.trakinvest.com

Type of Offer : Initial Coin Offering (ICO)

Total Tokens : 155,294,118

Accepted Currencies : Ether (ETH)

ERC20 Token : Yes

Token Main Sale Price : 1ETH = 1093 TRAK/ 1 TRAK Token = 0.000915 ETH

ICO Pre-Sale Dates : 8:00AM; December 16th 2017 (SST) — 8:00PM; January 19th 2018 (SST)

ICO Sale Dates : 8:00AM; January 19th 2018 (SST) — 8:00PM; February 3rd 2018 (SST)

Offering Structure : 66,000,000 tokens available

Pre-Sale

Tranch 1–11,000,000 tokens : 23.08% discount | 8a.m December 16th — 8p.m December 30th 2017.

Tranch 2–11,000,000 tokens : 15.25% discount | 8p.m December 30th 2017– 8p.m January 9th 2018.

Tranch 3–11,000,000 tokens : 8.42% discount | 8p. January 9th — 8p.m January 19th 2018.

ICO

Tranch 4–11,000,000 tokens : 4.31% discount | Starts on 8p.m January 19th 2018.

Tranch 5–11, 000,000 tokens : 2.25% discount | Starts automatically after Tranch 4 ends.

Tranch 6–11,000,000 tokens : 1.09% discount | Starts automatically after Tranch 5 ends.

In the 100% Token allocation, different percentages are distributed to individuals such as; Partnerships and early adopters, Management Team, Board of Advisors, M&A Expansion and BuyBacks, Bounty, Referrals & Community Blog and Pre-Sale & ICO.

e.g. in a token allocation of $100000000, the percentage goes thus:

Partnerships & early adopters: 5% = $5,000,000

Management Team: 23% = $23,000,000

Board of Advisors: 10% = $10,000,000

M&A Expansion and BuyBacks: 15% = $15,000,000

Bounty, Referrals & Community Blog: 5% = $5,000,000

Pre-Sale & ICO: 42% = $42,000,000.

N.B: Discount in each tranch is applicable until the end of the allocated tokens or allocated time being sold out. Any of which comes earlier will be regarded.

TrakInvest AI Engine: Unlocking Market Insights from Heterogenous Social Data.

It is no news that the creation of the Internet and the World Wide Web has resulted in the explosive great growth of online prediction communities and rich social investing datasets e.g. forum discussions, financial news, blogs, social media feeds, telegram channels and so on. The promise of providing accurate measures of investor trust is based on these datasets and makes it possible to evaluate investors not just by their popularity but by their historic performances and recommendations.

TrakInvest AI Engine allows to overcome challenges such as; the scattering of numerous datasets across many different sources, the vast differences of data sources in structure and organization and the generation of data through these sources at a very fast rate. This challenge is overcome by creation of the TrakInvest Knowledge Graph (TKG)- which involves all heterogenous datasets of interest to be viewed in a curated and modified manner. The TrakInvest AI Engine has three key initiatives which includes:

1. TrakInvest Knowledge Graph (TKG)

2. Sentiment Engine

3. Continuous Learning.

In a schematic view, the TrakInvest Knowledge Graph is built by the engine in which is done by automatically all structured and unstructured datasets of interest. After this, the estimation of crowd sentiments is done by the engine over various other components of TKG such as investor sentiments over securities, companies etc. Lastly, using a continuous learning mechanism will help to estimate the predictive power of such sentiments against actual market.

1. TrakInvest Knowledge Graph (TKG):Knowledge Graphs (KGs) are multi-relational graphs which consists of relationships between entities. It came as a result of having a very effective way of extracting and organizing knowledge from large unstructured datasets. Some leading search engines such as Google, Wikipedia and Bing make use of such KGs to improve web search experience. The TKG construction engine scans continuously a set of new sites, social media feeds, online discussion forums etc.to build the TKG. The TKG apparently consist of characters such as investors, analysts, securities, institutions and cryptocurrencies. The following are sub problems TrakInvest’s AI Engine solves to build the TKG:

a. Predicate Scheme Induction

b. Instance Population

c. Overcoming Scarcity using Deep Reinforcement Learning

d. Source Credibility Estimation.

e. Natural Language KG Interference

2. Sentiment Engine: Sentiments are read by TrakInvests sentiment engine from several unstructured text data and such entities and relationships are aggregated over in the TKG. An example is when an analysis recommendation for a particular security which has evolved over time is extracted and stored by the sentiment engine. In this same manner, an estimation of how crowd sentiments over a particular cryptocurrency has changed over time is done by the engine. Therefore, the TrakInvest Knowledge Graph in conjunction with sentiment over its various components helps in providing a holistic overview of such market conditions which covers various entities and stakeholders earlier stated above. Most importantly, it is very necessary to continuously update and expand this graph in order to change the world condition.

3. Continuous Learning:The TI-STOCK score, TI-ANALYST score and TI-TRADER score are known to supplement the TKG and sentiment analysis engine in which each of them provide a time sensitive quantitative metric where stocks, analysts and traders can be ranked. The continuous learning uses State-of-art Network Analysis, Deep Learning over Graphs, and Graph Embedding Techniques to estimate these scores. Computation and updating of these scores can be done with the aid of a continuous learning mechanism. The first step is to parameterize accurately the scores in which the updated parameters are correlated with the predictive power of the corresponding variable against real market signals. In summary, through this learning mechanism, it will be quite possible not only to estimate overall competency of an analyst but also to learn about biases in a data-driven manner.

Tokenomics

TrakInvest Token (‘TRAK’ token) is a utility token which is used to perform quite a variety of activities on the platform. The TRAK token demand is driven based on the strong pipeline of existing contracts with leading contracts with leading corporates and universities. As aforementioned, the utility tokens which are used to engage in TrakInvest services are primarily three which are i.) Tokenized data ownership. ii.) Tokenized reputation system iii.) Tokenized certifications.

Token Distribution

CUSTOMER ENGAGEMENTS

Through partnerships with universities, corporates and governments, TrakInvest continues to conduct semimars and workshops in Asia to drive customer acquisition.

TIMELINE

It’s one of those rare cases where the token is actually backed up by a platform that makes it spendable in the marketplace. It’s not only a spendable token. It’s an investment as well, growing with the platform in tandem.

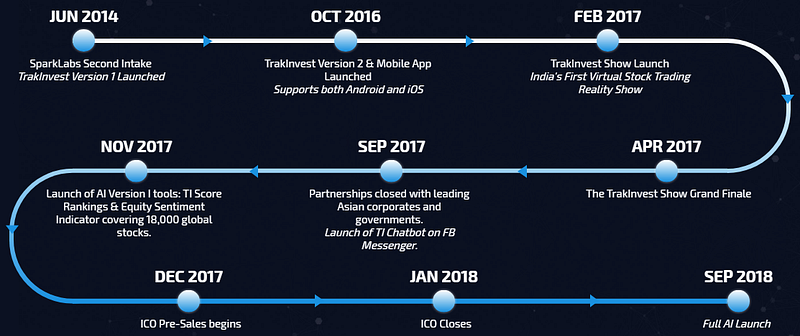

- June 2014. Release of the first version of Trakinvest.

- October 2016. Launch of the second version of the project and a special mobile application.

- February 2017. Release of the Trakinvest project in India.

- April 2017. The Trakinvest Show Grand Finale

- September 2017. Completion of cooperation with leading Asian corporations and state institutions.

- November 2017. Launch of 1 set of tools for trading operations.

- December 2017. Starting the ICO process.

- January 2018. The end of public sales.

- September 2018. The full launch of the automatic platform.

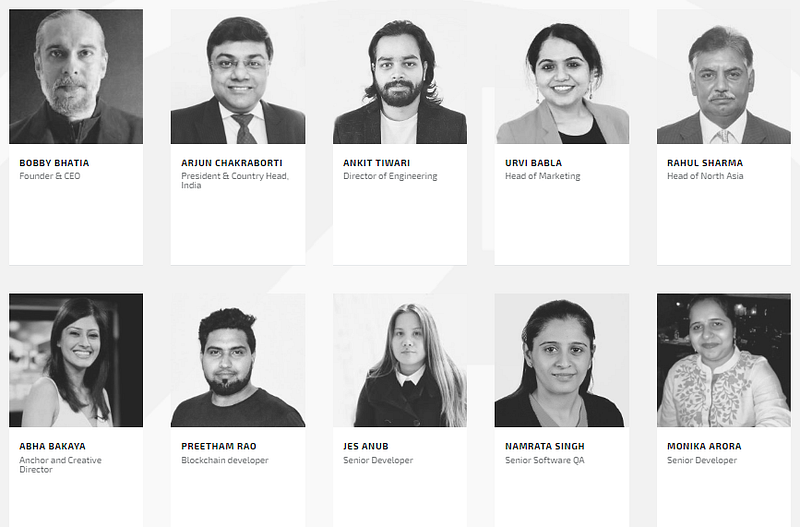

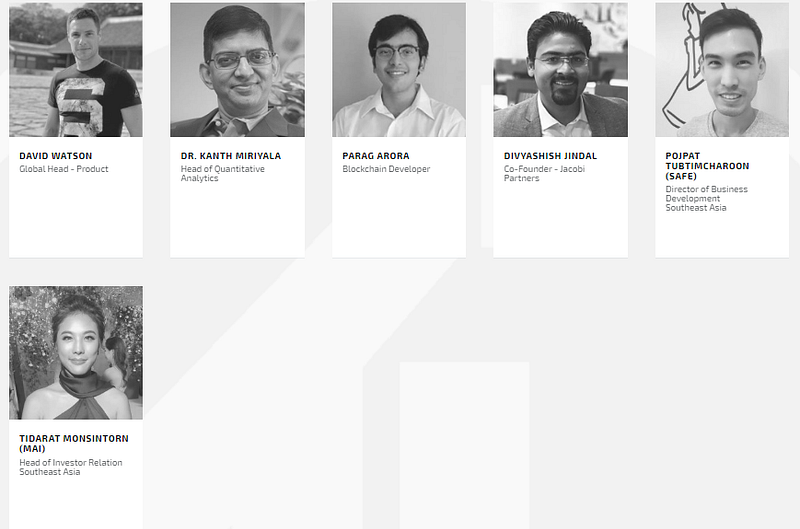

Team

Financial technology and product experts. Our collective experience gives us a unique view into the world of virtual trading.

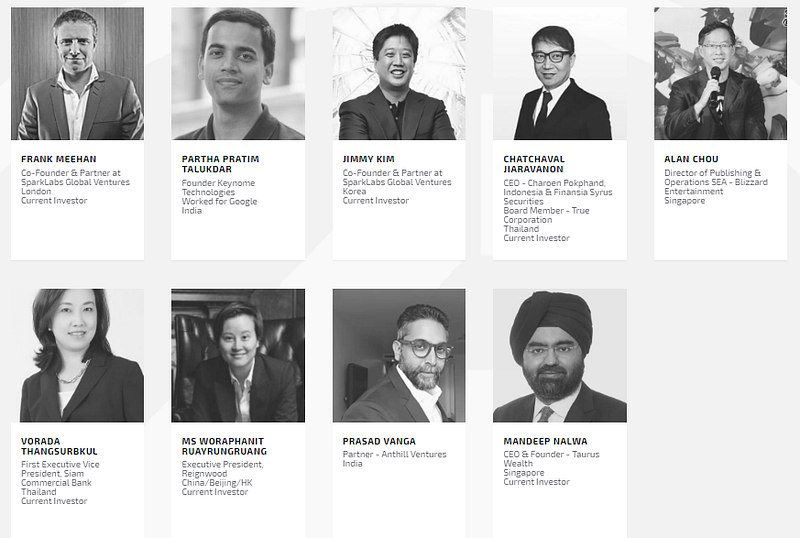

PARTNERS AND INVESTORS

TrakInvest is powered by these reputable institutions and companies.

BOARD OF ADVISORS

Website : https://trakinvest.ai/

Business Whitepaper : https://trakinvest.ai/files/ti-whitepaper.pdf

Technical Whitepaper : https://trakinvest.ai/files/trakinvest-ai-engine.pdf

Twitter : https://twitter.com/TrakInvest

Telegram : https://t.me/joinchat/GLe6KhCAs5bw4x6bNBYARw

Author

My Bitcointalk username : Liana Kurniawan

Komentar

Posting Komentar