KRYLL - AUTOMATED CRYPTO TRADING STRATEGIES MADE SIMPLE

Today we interviewed Kryll’s CTO Philippe Longère and CMO Olivier Paul Collorafi on our coinmonks slack community, Kryll is platform for building automated trading strageries and sharing them. Below is chat transcript of that interview.

Me: Tell us about Kryll.io? What is Kryll and why are you doing it?

Phil: Story started last year with my associate Luca and Paul, since we were trading cryptos for a while, and we’re doing our own bots on our side to try and save some (precious) time.

All were scripts in python or nodes, running on our servers etc…

But this is a cumbersome process and we could not share with our friends So the idea came up to make something easy to use (for coders or noncoders) and to share: Kryll.io.

All were scripts in python or nodes, running on our servers etc…

But this is a cumbersome process and we could not share with our friends So the idea came up to make something easy to use (for coders or noncoders) and to share: Kryll.io.

Me: Tell us a little bit more about automated trading?

Phil: So Kryll is not an “automatic” black box trading bot.You will define yourself (using the drag&drop interface, or renting somebody else’s work) what it should do, and then it’ll run automatically.

Paul: I have a strategy example to share with you guys.

with some explanations, What it does:

1 — Catch the start of the form on Callisto ETC hard fork (sentiment analysis + volume & price increase, using social media)

2 — Buy ETC

3 — If market drop: false flag, short ETC + SMS alert + stop strategy

4 — If price increased (fomo) sell ETC @+15%, send email, stop

this kind of strategy will be built by Kryll users, they will be able to rent them also in the marketplace.

1 — Catch the start of the form on Callisto ETC hard fork (sentiment analysis + volume & price increase, using social media)

2 — Buy ETC

3 — If market drop: false flag, short ETC + SMS alert + stop strategy

4 — If price increased (fomo) sell ETC @+15%, send email, stop

this kind of strategy will be built by Kryll users, they will be able to rent them also in the marketplace.

Me: Does kryll will help any who has no experience in trading because most of the traders in crypto space are new to trading?

Phil: It will because it’s easy to use (flows), and will have free testing (back-test or live simulation) capabilities. So people can try it easily with no risks.

We’re coming from the video game, and free-to-play is something we adhere to.

We’re coming from the video game, and free-to-play is something we adhere to.

Uttam(A community Member): So basically the user can define rules for trading and they can share it with other Kryll users, right?

Phil: Also, we want the whole thing (again video games) to be user-friendly and community-driven because that’s how we have learned to make great stuff in the past.

Yep, there will be a marketplace where users with nice ideas can share their work (for a fee they will decide).

Yep, there will be a marketplace where users with nice ideas can share their work (for a fee they will decide).

Me: Are you using any new tech for this? (something built in-house)..of course, the whole platform builds in-house ..is there something new that’s new to automated trading space ?

Phil: Well apart (as you said) from the platform, we will emphasize our R&D on tools like sentiment analysis (we work with Eurecom institute on that) and AI-based predictors that can be associated (or not) with more regular TA indicators to create new decision making approaches.

Me: So tell us about your roadmap? where are you now where are going in next 2 years ?

Phil: Right now we have some code running server side (the code I was mentioning in introduction), UI is being built (the GIF Paul posted is a recording of it), we’ll release an alpha version during summer, my guess is also a pre-alpha (with like 10 selected testers to avoid any FUD on token) in June, then before the end of 2018 a beta release for everyone.

Next year we’ll boost up (it takes some R&D) the sentiment analysis and IA tools with our advisors.

Then we’ll work on an SDK to offer other the possibility to make “blocks” of their own.

Next year we’ll boost up (it takes some R&D) the sentiment analysis and IA tools with our advisors.

Then we’ll work on an SDK to offer other the possibility to make “blocks” of their own.

Me:”Then we’ll work on an SDK to offer other the possibility to make “blocks” of their own.” it means platform distribution ..?

Phil: We think there are people out there with ideas and coding skills, we want to offer them the possibility to be integrated into Kryll as new blocks (for which they will take a share of the running fee of course). We will provide a lot of blocks on the platform (we have listed 50 so far), but there may be some missing, so either the community tells us that this would be nice and we decide to build it, or some people will do it on their side and provide it.

Paul: also each of these blocks will bring passive revenues to its developer.

Me: Can you explain these block concept ..what are they and how they fit in the kryll platform?

Phil: Take the example of the Twitter sentiment analysis block :

We’ll work with Raphael at Eurecom on that matter because they have expertise on that, and provide a block that will (for example) give an indication that ETC is having a pretty good mood on social networks. But this will only be a way to analyze and do that, maybe someone in the field as well will be able to trace either different sentiment or do it another way that could be valuable as a “base block” as well. The SDK will give that person the possibility to be in the pack of blocks as if it was one of our own, or almost.Or your question was about blocks in general, not related to the future SDK ?

Me: Blocks in general?

Phil: blocks are the elements of the flows, they can either be logical operators, signals, variable values (like a market volume, trend, any TA indicator), notifications to the user, orders. Using those you can build the flow of your strategy very easily (took less than a minute to design the GIF posted earlier) before testing them, and running them.

Me: great ..a general question how you see crypto space in next 2 year?

Phil: This year I see (and we all see) many new people entering the space (and an easy to use tool could be cool for them) .

Regulations should take place everywhere for the good of all players.(and to get more people aboard as well)

And then, we have yet to see (apart from Ethereum and a few others) a real blockchain application give value and credit (for those pseudo non-believers) to the whole space.

Regulations should take place everywhere for the good of all players.(and to get more people aboard as well)

And then, we have yet to see (apart from Ethereum and a few others) a real blockchain application give value and credit (for those pseudo non-believers) to the whole space.

Uttam(A community Member): cool, but how will you define a correct sentiment through social platforms because somebody can easily influence or push his thought process through these platforms?

Paul: sentiment through social platforms can be achieved via AI with a good accuracy actually

Phil: There are parameters that you cannot cheat, for example, the power of real influencers (that cannot really cheat because they would do that only once). And also manipulation is actually part of the game right now.

Phil: There are parameters that you cannot cheat, for example, the power of real influencers (that cannot really cheat because they would do that only once). And also manipulation is actually part of the game right now.

Me: and I think we can trust these platforms(like twitter) .because they also need to protect themselves ..so they also monitor spams ..but sentiment can be influence strategically ..but it will take effort.

Phil: Yep, that’s why it is on our R&D timeline, won’t be perfect at first, and will take some work.

We thanks,Phil and Paul for their time and Now they are our community member too.

Check out our latest interview A glimpse inside the latin America Crypto market, Interview with Alteum Founder Victor?

We have an active community if you want to how we are building it check here.

Subscribe our newsletter where we share interviews, trading Ideas, Market insights here.

If you are investor, Trader, developer or crypto enthusiast or just have a lot of questions about how heck crypto works, come join us on our slack community. Our Crypto Forum CoinMonks and also check out our website which ranks crypto according to their development progress CoinCodeCap.

Platform for designing automated, effective strategies for the crypto trader:

Today in this post we discuss about one of the unique platforms that is designed for the crypto trader to ensure their success and support their process of profit maximization. As we all know that without the effective strategies the chances to get the success in the future reduce and risk become high. As with the advancement in the blockchain and the crypto world, most of the people try it with the attention to expand their business and to ensure the high profits. But most of them experienced loss because they don’t start operations with proper strategies. But, the game of trading in the crypto world is not much easy as it requires the time, the technical knowledge, the analytical skills, the discipline and the proficiency in utilizing the professional tools to achieve the high success otherwise you will suffer from loss and lost many of your assets. I am sure while reading this many of you remember about your bad experience that you face just because of poor strategies. I personally suffer from this as I am one of the traders that get attracted by crypto trading when I hear about it from my friend and want to try it. At that time, I get excited and no care about the proper strategy and start trading on it and after some time when I face loses continuously I become disappointed and tell my friend at that time he tells me about the main issue for this loss. He explains to me that you start trading without proper strategies and without analytical and technical knowledge that’s the main reason for your lose. After that I find the platform that helps me in this and this search ends when I know about the Kryll.io.

Kryll.io is the first intuitive network that helps the crypto trader to design their effective and powerful strategies and execute them automatically. Now I tell you about how you use it in this platform you will become able to create the automated strategies, able to benchmark them and share them with the community by just the simple way of drag-drop editor. The most interesting point of this platform is that in this the community members of the platform become able to use the other members content to make effective strategies for themselves. As the community member whose strategy proves success will also rent it out for helping other and will get the reward on it. So, by this platform, you earn maximum advantages as your business success improves and revenues increase and through rent strategies you also earn revenue from it. I must tell you that the success of the platform sure because of the talented team that was trading the cryptocurrencies as a hobby for many years. So, they are experienced close circle with developers and the economist that also help them to improve their performance. So, if you are an investor than this platform is also valuable for you and help you in the maximization of your profits.

The price of one KRL token is USD 0.2 that is affordable for all. It accepts many currencies like BTC, ETH, DASH, BCH, LTC, ZEC. So, I conclude that it’s a user-friendly efficient platform for the crypto traders and the investors. So, if you are planning to join crypto world, you must try this platform I am sure it proves valuable for you. The ICO of this platform start from 7th February 2018 and end on 20th March 2018. So, time short makes your decision and participate in the ICO of it to maximize your profits.

Investing in cryptocurrency can be lucrative but the process of investing can be frustrating, thanks to unreliable tools. In December, TechCrunch reported on several existing trading tools that took hours to push trades through. Demand is high, but the development of industry tools lags behind the financial growth of this currency sector. This is a huge problem that Kryll aims to fix.

What Is Kryll?

Kryll is a crypto trading platform for traders. It uses the foremost tools and strategies, and combines the intelligences of community to get the highest profit in the crypto currency market.

Kryll platform has various interesting things to define its own trading strategies and it is operated automatically. From the interface “what you see is what you trade”, we can design the trading strategies from the fantastic industrial tools and do the back test and sand boxing.

When the tools show an optimal progress, we can bring them to the live trade session and take the position on the opportune time. Also we can keep up the market progress for 24/7. Furthermore, we can rent our tools to the other traders. The tools rental not only can help the other traders but also can give us the passive income.

How does Kryll work?

Using Kryll is basically a four-step process.

First, you’ll utilize drag ’n’ drop blocks to build your strategy on the visual platform. You can do this for simplistic or more advanced strategies. You’ll pull these blocks from 5 categories: market trends, trading actions, signals, operators, and notifications. Then, you’ll test your new strategy through back-testing. This process uses real market data to draw conclusions. You can also use sandbox stimulation at this stage.

Once you’re satisfied with your strategy, you’ll put it to work and it’ll keep going 24 hours a day, 7 days a week. You can share winning strategies with the Kryll marketplace or you can mine the community for strategies that have worked for others.

Kryll is a solution for the auto crypto trading.

Kryll platform promises an efficient trading tool that uses the technology “what you see is what you trade”. There are 5 tools which are used to define the strategies:

a. Trending Market

It is the case when the market volume and price fluctuation is changed. Analyzing the case, making it to be technical data analysis and learning of it can be the reference of trading.

b. Trading Action

It is a moment when the buying, selling, merging buy and sell are happened.

c. Trading Signal

It comes from the professional traders from any media such as telegram, twitter, and etc. It can be either paid or free.

d. Operator

It is a computation language which processes the data (Trending Market. Trading action) using the obtained signal.

e. Notification

It is needed in order that costumers get the information about their trading strategies status. It can be short message, email, or smart notification.

By using those methods, we can make the competent tools trading that are ready to be competed in the big/macro market.

Kryll platform provides back test option which has more than 6 months recorded data. It also uses more than 250 pair currency and very fast frequency. All of those components will facilitate us doing the back test.

Besides providing the platform to make the trading tool by using the reliable strategies, kryll also provides an application to monitor the performance of the tools.

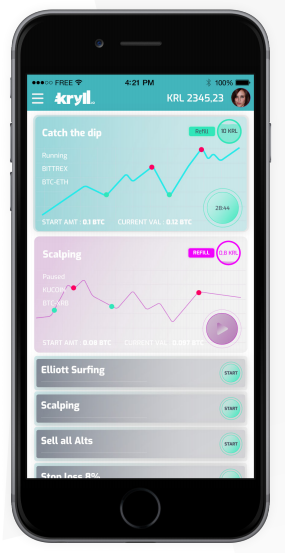

The Kryll App

One of the greatest advantages of using Kryll is its companion app. Users can download and sync the app with the web platform. This enables real-time access to your dashboard and you can receive push notifications when there are new developments in your strategy. Furthermore, it becomes much easier to stay up to date with your crypto trades as opposed to logging onto a more complicated platform or service.

Other platforms and apps notify you when it’s time to make a move to either take advantage of a great opportunity or avoid a significant loss of value.

Kryll simply notifies you that action has already been taken. Even better, despite the automation of your strategy, you still have the option to interact with the platform and maintain your control over your trades, right from your smartphone or mobile device.

Kryll simply notifies you that action has already been taken. Even better, despite the automation of your strategy, you still have the option to interact with the platform and maintain your control over your trades, right from your smartphone or mobile device.

Kryll Companion app

This application is mobile based which is completed by push notification system. This system will give us the notification in a real time.

Not only monitoring the performance tools and notifications in a real time, but also controlling tools can be handled by only one hand.

Exchange Support

The Kryll.io platform will be interconnected via API to all exchanges that provide one.

This massive support will also allow you to use a single platform to manage your entire portfolio’s strategy.

The first set of supported exchanges includes the following platforms:

Bittrex, Poloniex, Kucoin , Coinbase/Gdax, Cryptopia, YoBit.net, Binance, HitBTC, Bitstamp, Liqui.

Bittrex, Poloniex, Kucoin , Coinbase/Gdax, Cryptopia, YoBit.net, Binance, HitBTC, Bitstamp, Liqui.

Smart Token economy

Strategy cost

The Kryll.io platform economy relies on its utility tokens (KRL) that can be spent when using a strategy in live trading. Just like each smart-contract execution costs on the Ethereum blockchain depends on the complexity of the code, each live trading strategies execution on the Kryll.io will cost some energy (KRL fractions) depending on the complexity of the task performed. Strategy creation, backtests and sandbox testing will be free for all users.

Cost governance

Since the token value (as compared to USD) will vary over time, an autonomous decentralised smart-contract will re-assess every 48 hours the energy needed to run the blocks in order to keep it at a fair level for everyone, whatever the value of the token takes over time.

Community provided

Strategies When using a strategy provided by a creator, energy will be sent to the platform to fuel it, as well as an excess of Krylls set by the creator as a reward for the work, Kryll.io will never take a fee on strategy sharing or renting.

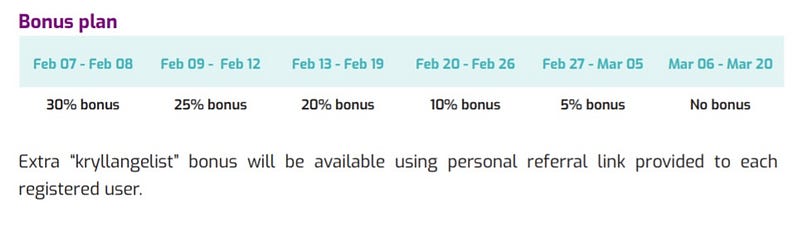

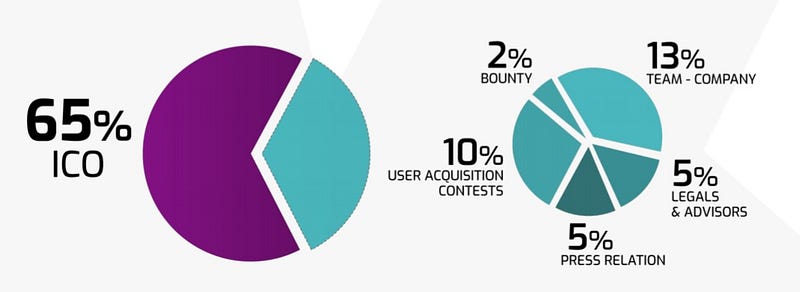

The Kryll Token Sale

To further boost Kryll’s capability, the platform is launching a token sale on the Ethereum blockchain for Kryll tokens (KRL). Through the use of smart-contracts, Kryll will offer KRL through the end of March 2018.

You can purchase KRL from your MyEtherWallet by logging into your Kryll account at https://sale.kryll.io/sign-in. Don’t worry — if you don’t have a Kryll account just yet, you can easily start one using the aforementioned link. After you’ve logged in or set up your account, head to the “Invest in Kryll.io” tab and generate your ETH address. Copy that address and then access your MyEtherWallet account.

This address is generated for your account and your account only, so you’ll receive notifications anytime KRL is added to the corresponding account.

Once you’ve accessed your MyEtherWallet account, follow these steps:

Go to https://www.myetherwallet.com/#send-transaction

Go to https://www.myetherwallet.com/#send-transaction

Click “To Address”: Paste the ETH address you generated on your Kryll.io dashboard. Then click “Amount to Send”: Enter the desired amount of ETH you are willing to send to buy KRL tokens.

Click Gas Price (1): Recommended is “21 Gwei”

Click Gas Limit (2): Recommended is “21000”

Click Gas Limit (2): Recommended is “21000”

After entering satisfactory settings, complete the transaction by clicking “Generate” and then “Send”. Confirm and then verify your order when prompted, and you’re done. Visit here for the complete guide to purchase KRL tokens from MyEtherWallet.

Token sale information

Token Allocation

Funds usage

Exchange listing

ROADMAP

Team

LUCA BENEVOLO

CEO — Founder — Architect

PHILIPPE LONGERE, Ph.D.

CTO — Founder

PAUL COLLORAFI

CMO — Strategist

FRANCIS PRAT

Artistic Director

FABIEN MABON

Back-end Expert

JAY SALVAT

Front-end Expert

LISA PONS

Marketing & Public relations

JEREMY BLOT

Community Manager

ADVISORS

The Advisors behind the project.

JERÔME CHIFFLET

Innovation manager

Orange Labs Research

Orange Labs Research

THOMAS HERLIN

Business Development Accelerator

EIT Digital

EIT Digital

NICOLAS IVALDI

Founder of Ventury Avocats

Lawyer at Ernst & Young

Lawyer at Ernst & Young

CLÉMENT LAFORET

Scalability Expert

FreeBSD Contributor

FreeBSD Contributor

PATRICK MUSSO

Head of economics Research at CNRS

National Center for Scientific Research

National Center for Scientific Research

MILIE TAING

Founder & CEO of lili.ai

Machine Learning Speaker / Consultant

Machine Learning Speaker / Consultant

SYLVAIN THEVENIAUD

Managing Director

Allianz Accelerator

Allianz Accelerator

RAPHAEL TRONCY

Head of the Multimedia Semantics group

EURECOM Research Center

EURECOM Research Center

PUI-CHING CHAU

Asian Market consultant

Innovation Philosopher

Innovation Philosopher

FOR MORE INFORMATIONS :

Website : https://kryll.io/

Whitepaper: https://kryll.io/pdf/WhitePaper.pdf

Ann Thread : https://bitcointalk.org/index.php?topic=2791849.0

Twitter : https://twitter.com/kryll_io

Facebbok : https://www.facebook.com/kryll.io

Telegram: https://t.me/kryll_io

Whitepaper: https://kryll.io/pdf/WhitePaper.pdf

Ann Thread : https://bitcointalk.org/index.php?topic=2791849.0

Twitter : https://twitter.com/kryll_io

Facebbok : https://www.facebook.com/kryll.io

Telegram: https://t.me/kryll_io

AUTHORSHIP BY Liana Kurniawan

My Bitcointalk profil : https://bitcointalk.org/index.php?action=profile;u=1352447

My Bitcointalk profil : https://bitcointalk.org/index.php?action=profile;u=1352447

Komentar

Posting Komentar