EQUI - an innovative investment platform with BlockChain Technology.

Be it a start-up IT company or a small-scale business, every organization needs initial capital for its development. Even though many start-up companies have the potential for growth, not all businesses are backed by government or banks as it is not possible to eliminate the risk associated with this kind of start-ups. Who is willing to take the risk and provide financial support for these companies? Mostly, it comes from institutional investors and other financial institutions. This type of capital investment is called Venture Capital, and the investors are called Venture Capitalist. The term Venture Capital not only describes the monetary help but also can be technical support, management/administrative support, etc.

Without this funding, many of the biggest company could not make their presence in the market as banks don’t provide loans to such companies. So Venture capital is essential for the current market, and it is becoming very popular as the investors are making big money in funding of these businesses. Sometimes, it is a failure also as the investments are too risky. As this fund is not a bank loan, you can raise a large amount of capital for your company easily as there is no limit of cash funding.

In Venture capital you just don’t have financial help, venture capitalist also helps you with their expertise of existing managerial team like Human Resources, Information technology team, etc.

But, there are two limitations in the existing venture capital market which are given below:

- Most of the venture capitalists are interested to fund only projects related to IT (Information Technology, Biotechnology, etc. as they believe that they only can give high returns for their investments. Because of that, innovative start-ups related to other technologies are getting unnoticed and not getting the needed financial support.

- Also, venture capitalists are mostly firms and institutional investors. Why there is no option for a young and aspiring individual to become a venture capitalist?

EQUI overcomes the above limitations and connects the innovative start-ups with like-minded investors. What is EQUI? EQUI is a blockchain based platform which aims to bring revolution in the Venture capital market by allowing the individuals to invest in the future companies along with established firms and institutional investors. How will you feel if you had an opportunity to invest in Google 15 years ago? Sounds exciting? Kindly visit the official whitepaper https://www.equi.capital/whitepaper/EQUI_Whitepaper_050218.pdf

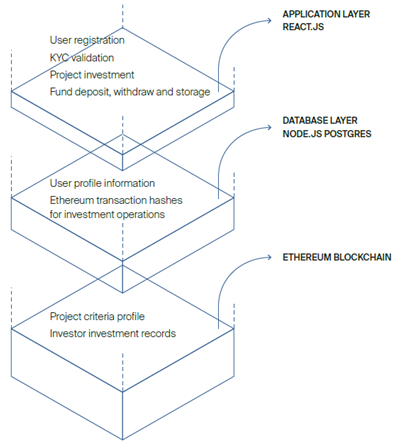

EQUI platform will list projects in various fields that have a great potential for growth after an extensive validation process by its team. Every project that is listed on the platform will have a complete project description, duration, milestones, etc. If someone is interested to invest in a project using this platform, then he/she need to hold a special utility token named EQUITOKENS. EQUITOKENS are based on Ethereum ERC20 standard and are the only payment method for accessing any type of service on EQUI

ASSET NAME: EQUI

TOTAL OBTAINMENT SUPPLY: 250 million EQUItokens

PRICE IN USD: $0.50

PAYABLE IN: Bitcoins (BTC), Ether (ETH), Litecoins (LTC), Ripple (XRP)

Assigning Tokens

TOTAL OBTAINMENT SUPPLY: 250 million EQUItokens

PRICE IN USD: $0.50

PAYABLE IN: Bitcoins (BTC), Ether (ETH), Litecoins (LTC), Ripple (XRP)

Assigning Tokens

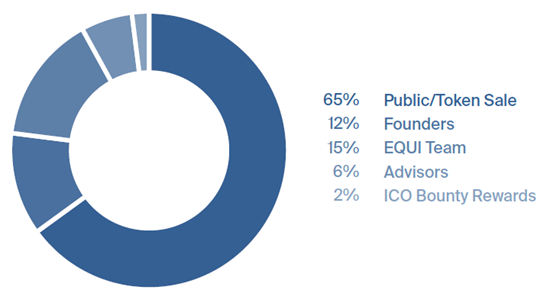

The distribution of EQUItokens focuses on the creation of long-term value for investors:

65% of the tokens will be put on sale to the public through the pre-sale and ICO process.

12% will be distributed to the founding members of EQUI, subject to a six-month blocking period.

15% is distributed quarterly to the EQUI team over a two-year period, subject to a six-month lock-in period.

Six per cent will be distributed to the Advisory Board on a quarterly basis, for a period of two years, subject to a six-month standstill period.

2% will be available to Bounty Rewards.

12% will be distributed to the founding members of EQUI, subject to a six-month blocking period.

15% is distributed quarterly to the EQUI team over a two-year period, subject to a six-month lock-in period.

Six per cent will be distributed to the Advisory Board on a quarterly basis, for a period of two years, subject to a six-month standstill period.

2% will be available to Bounty Rewards.

EQUI Platform:

Fundadores

DOUG BARROWMAN - Fundador Principal

BARONESS MONE DE MAYFAIR, OBE - Cofundador

BARONESS MONE DE MAYFAIR, OBE - Cofundador

Equipo de inversión

TIM EVE - Director de Inversiones

LUKE WEBSTER - Director de Inversiones

MARK LYONS - Director de Inversiones

ANDREW BARROWMAN - Gestor de inversiones

LUKE WEBSTER - Director de Inversiones

MARK LYONS - Director de Inversiones

ANDREW BARROWMAN - Gestor de inversiones

Equipo del proyecto

ANDREI KARPUSHONAK - Responsable de Desarrollo

NERYS ROBERTS - Directora de Marketing

NICHOLAS GRAHAM - Responsable de Atención al Cliente

SIM SINGH-LANDA - Gerente de Proyecto

ANTHONY PAGE - Patrono

MACINAS DE DUNCAN

NERYS ROBERTS - Directora de Marketing

NICHOLAS GRAHAM - Responsable de Atención al Cliente

SIM SINGH-LANDA - Gerente de Proyecto

ANTHONY PAGE - Patrono

MACINAS DE DUNCAN

Equipo Asesor - Emprendedores

MARK PEARSON

MORTEN TONNESEN

MORTEN TONNESEN

Equipo Asesor - Crypto

JONAS KARLBERG

JOHN CALDWELL

DUNCAN CAMERON

JOHN CALDWELL

DUNCAN CAMERON

Enlaces de Interés:

Sitio Web: https://www.equi.capital/

Whitepaper: https://www.equi.capital/whitepaper/EQUI_Whitepaper_050218.pdf

ANN: https://bitcointalk.org/index.php?topic=2888110

Telegram: https://t.me/equicapital

Twitter: https://www.twitter.com/equi_capital

Facebook: https://www.facebook.com/equi.capital

Reddit: https://www.reddit.com/r/EQUIcapital/

Youtube: https://www.youtube.com/channel/UCroAksegMhfQpwQEudz8uQA

Whitepaper: https://www.equi.capital/whitepaper/EQUI_Whitepaper_050218.pdf

ANN: https://bitcointalk.org/index.php?topic=2888110

Telegram: https://t.me/equicapital

Twitter: https://www.twitter.com/equi_capital

Facebook: https://www.facebook.com/equi.capital

Reddit: https://www.reddit.com/r/EQUIcapital/

Youtube: https://www.youtube.com/channel/UCroAksegMhfQpwQEudz8uQA

AUTHORSHIP BY Liana Kurniawan

My Bitcointalk profil : https://bitcointalk.org/index.php?action=profile;u=1352447

Komentar

Posting Komentar